Our climate approach

Achmea Bank and Achmea Group B.V. are committed to and supportive of the Paris Climate Agreement as part of the Dutch financial sector.

This agreement set goals for the financial sector to:

- To act as a financier of the energy transition;

- Create transparency about the CO2 emissions of their investment portfolios;

- Announce new CO2 emission targets including reduction plans (end of 2022).

With this, the sector aims to reduce CO2 emissions by 49% compared to 1990. Achmea Bank takes its responsibility by translating this objective into relevant targets to be achieved with and for various stakeholders. In our ESG impact report we describe how we will achieve our climate ambitions.

Green Finance Framework

Guidelines for sustainable investing

As a major investor, Achmea wants to take its responsibilities. The knowledge and focus within our sustainable investment policy is bundled. Through our investments, we aim to create long-term social value. We do this by applying (international) guidelines for responsible investment. Below you can read which guidelines these are. We use various instruments to implement these guidelines in the investment process. This includes the exclusion policy, engagement, voting, ESG integration and impact investing. We also expect our service providers to act in line with these guidelines and to work with us to achieve our objectives.

Global Compact UN

Achmea tests its responsible investment policy against the Global Compact of the United Nations. We use these principles as a guideline when conducting engagement and completing part of the exclusion policy. Global Compact includes: the Universal Declaration of Human Rights, the ILO Declaration on Fundamental Principles and Rights at Work, the Rio Declaration on Environment and Development and the UN Convention against Corruption.

Climate Agreement

Achmea supports the 2019 Climate Agreement. We do this, among other things, by investing in renewable energy and by appealing companies in which we invest, to take measures to reduce their greenhouse gas emissions.

Sustainability of services

Achmea's services, and therefore also Achmea Bank, will be climate neutral by 2050 at the latest. Or as soon as possible. We determine this on the basis of scientific data that helps us to define our goals as clearly as possible. We have the ambition to make sustainable solutions accessible to all Dutch people, both consumers and companies. We do this on the basis of adaptation, becoming resilient to the consequences of climate change, and mitigation, combating further climate change. We have adopted the following measures in the field of services and insurance:

- We develop services that help our customers to become resilient to the consequences of climate change. Examples of this are the ‘Groene Daken’ that we offer through Interpolis and the ‘Duurzaam Woongemak’ of Centraal Beheer.

- We also develop services that help to combat further climate change. This includes solar panels from Centraal Beheer, encouraging homeowners to become more sustainable via our mortgage, but also making the damage chain more sustainable (sustainability as part of contracting, together with suppliers) and making real estate more sustainable through Achmea Real Estate.

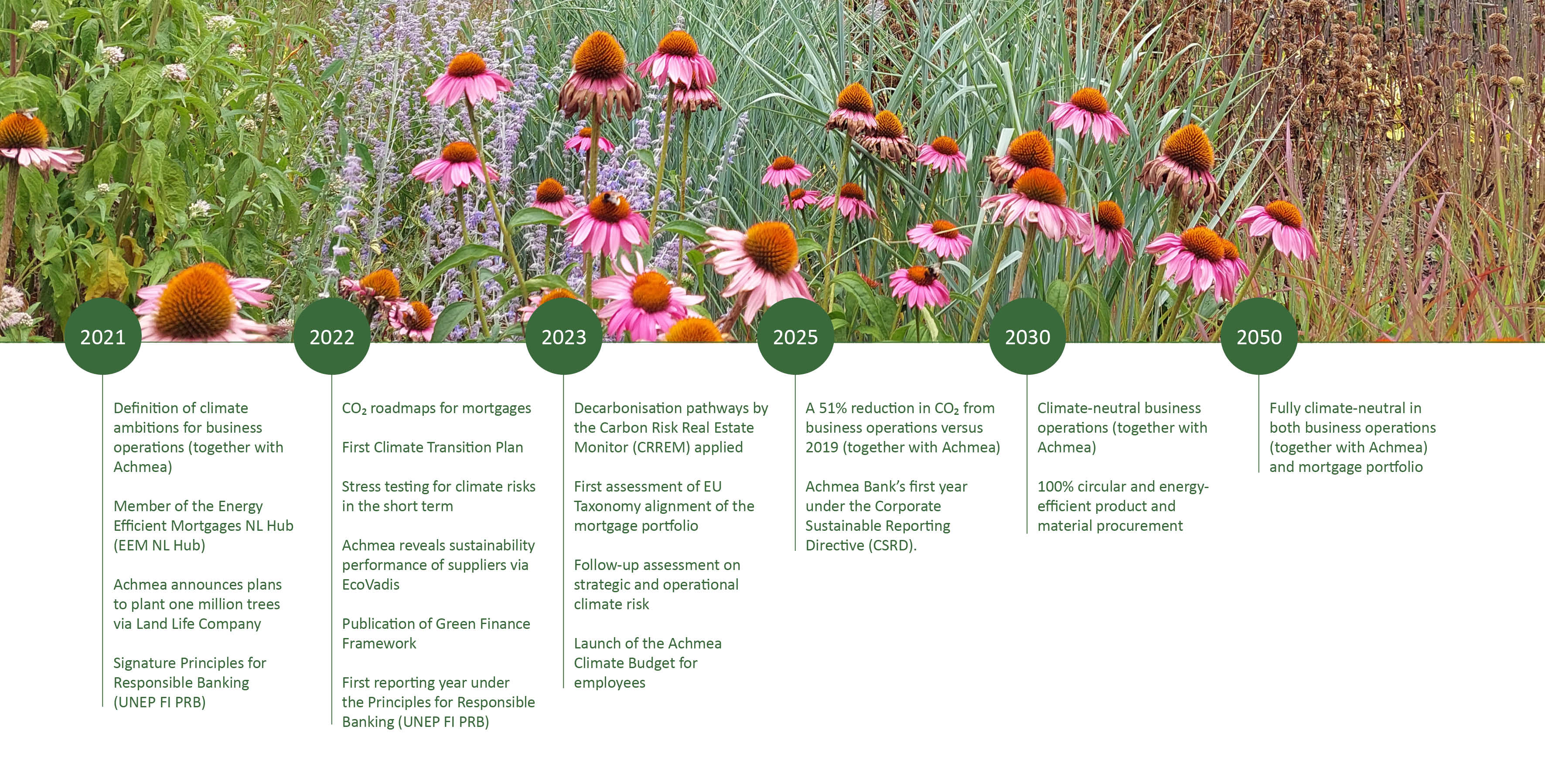

Climate transition path